As a plan sponsor or administrator, understanding Form 5500 is crucial for maintaining compliance and ensuring the smooth operation of your employee benefit plans. This comprehensive guide will walk you through everything you need to know about Form 5500, from its purpose and filing requirements to common challenges and best practices for submission.

What is Form 5500?

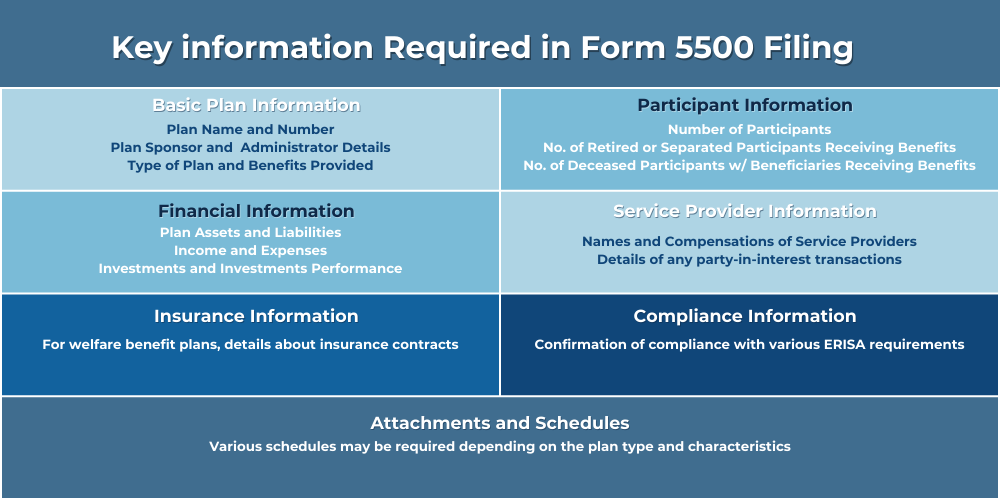

Form 5500 is an annual report required by the Department of Labor (DOL), Internal Revenue Service (IRS), and Pension Benefit Guaranty Corporation (PBGC) for employee benefit plans. It provides essential information about a plan’s financial condition, investments, and operations.

Form 5500, officially known as the “Annual Return/Report of Employee Benefit Plan,” is a crucial document in the world of employee benefits and retirement plans. It serves as the primary reporting mechanism for plan sponsors to provide detailed information about their employee benefit plans to the federal government. It is required by he Department of Labor (DOL), Internal Revenue Service (IRS), and Pension Benefit Guaranty Corporation (PBGC).

Purpose of Form 5500

Form 5500 serves multiple critical functions in the employee benefits landscape, acting as a cornerstone for regulatory compliance, transparency, and data-driven decision-making in the administration of retirement and welfare benefit plans.

Compliance

Form 5500 serves as a comprehensive checklist, prompting plan administrators to review and confirm their compliance with various ERISA requirements annually. This includes verifying proper plan administration, adherence to fiduciary duties, and maintenance of required documentation. By mandating regular reporting, Form 5500 helps create a culture of ongoing compliance, encouraging plan sponsors to stay current with evolving regulations and best practices.

Transparency

The public nature of Form 5500 filings allows participants to access detailed information about their plans, fostering trust and accountability in plan management. This transparency enables employees to make more informed decisions about their participation in the plan and their overall retirement planning. Additionally, it can serve as a valuable tool for employee education, helping participants understand the structure, performance, and costs associated with their benefit plans.

Monitoring

Through Form 5500, regulatory agencies can identify potential red flags or areas of concern in plan management, such as significant changes in asset values, unusual investment patterns, or high administrative costs. This monitoring capability enables agencies to focus their enforcement efforts more efficiently, targeting plans that may require closer examination or intervention. Moreover, it helps in tracking long-term trends in plan health and stability across different industries and plan types.

Data Collection

The aggregated data from Form 5500 filings provides a comprehensive view of the employee benefits landscape in the United States, informing policy decisions at both the federal and state levels. This data helps policymakers understand trends in retirement savings, healthcare coverage, and other employee benefits, allowing them to craft more effective legislation and regulations. Furthermore, this wealth of information supports academic research and industry analysis, contributing to a deeper understanding of employee benefit trends and their impact on workforce dynamics and the broader economy.

Who Must File Form 5500?

Generally, the following types of plans must file Form 5500:

- Pension plans (including 401(k) plans)

- Welfare benefit plans (e.g., health, life, and disability insurance)

- Certain fringe benefit plans

However, there are some exceptions based on plan size and type. Small welfare plans (fewer than 100 participants) that are unfunded, fully insured, or a combination of both may be exempt from filing.

Form 5500 Variations

The Department of Labor and IRS have created different versions of Form 5500 to accommodate various plan sizes and types, ensuring that reporting requirements are appropriately tailored to the complexity and scale of different employee benefit plans.

Form 5500: The standard form for large plans (generally, those with 100 or more participants).

This comprehensive form requires detailed financial information and often necessitates an independent audit. It includes multiple schedules that must be completed based on the plan’s characteristics, such as Schedule H for financial information, Schedule C for service provider information, and Schedule A for insurance information. Large plans using this form must file electronically through the EFAST2 system and are subject to the most rigorous reporting requirements.

Form 5500-SF: A simplified version for small plans (generally, those with fewer than 100 participants) that meet certain conditions.

The SF stands for “Short Form,” and as the name suggests, it provides a streamlined reporting process for eligible small plans. To qualify for this form, plans must be fully invested in eligible plan assets, have fewer than 100 participants, and meet other specific criteria. While simpler than the full Form 5500, the SF version still requires detailed information about the plan’s finances, investments, and operations. It’s designed to reduce the administrative burden on smaller employers while still providing necessary oversight.

Form 5500-EZ: Used by one-participant plans or certain foreign plans.

This form is specifically for plans that only cover a business owner (and potentially their spouse) or certain foreign plans. It’s the simplest version of Form 5500 and is typically filed directly with the IRS rather than through the EFAST2 system. While it requires less detailed information than other versions, it still includes important data about plan assets, investments, and basic operations. Plans eligible for Form 5500-EZ may be exempt from filing in some years if their total assets are below a certain threshold, currently set at $250,000.

Understanding which form variation applies to a particular plan is crucial for proper compliance. Plan sponsors and administrators should carefully review the eligibility criteria for each form to ensure they’re using the correct version. Additionally, as plans grow or change over time, they may need to transition from one form variation to another, requiring careful attention to evolving reporting requirements.

Filing Deadlines

Understanding and adhering to Form 5500 filing deadlines is crucial for plan sponsors and administrators to maintain compliance and avoid penalties. Here’s a detailed look at the deadlines and related considerations:

Standard Deadline

The deadline for filing Form 5500 is generally the last day of the seventh month after the plan year ends. For calendar year plans, which are the most common, this means July 31 of the following year. For example, a plan year ending December 31, 2023, would have a filing deadline of July 31, 2024.

Extension Options

- Automatic Extension: Plan administrators can receive an automatic 2 1/2 month extension by filing Form 5558 (Application for Extension of Time to File Certain Employee Plan Returns) before the original due date. This extends the deadline to October 15 for calendar year plans.

- Special Extension for Certain Plans: Plans that have aligned their Form 5500 filing with the tax return of the plan sponsor can receive an automatic extension if the plan sponsor has been granted a tax filing extension. This option is particularly relevant for single-employer plans.

Important Considerations

- Weekends and Holidays: If the filing deadline falls on a weekend or federal holiday, the due date is extended to the next business day.

- Short Plan Years: For plans with short plan years (less than 12 months), the filing deadline is the last day of the 7th month after the short plan year ends.

- Final Return: If a plan is terminated, the Form 5500 must be filed by the last day of the 7th month after the date of termination.

- Electronic Filing Requirement: All Form 5500 series returns must be filed electronically through the EFAST2 system. The timestamp of the electronic submission determines whether the filing is considered timely.

- Partial Year Reporting: New plans that are established after the first day of a normal plan year may report for a partial year, with the filing deadline based on the date the plan was established.

- Multiple Employer Plans: These plans have the same filing deadlines as single-employer plans, but the administrator must ensure all participating employers provide necessary information in time to meet the deadline.

- Disaster Relief: In cases of natural disasters or other extraordinary circumstances, the IRS and DOL may provide deadline relief for affected plans.

Consequences of Late Filing

- DOL Penalties: Late filings can result in penalties of up to $2,259 per day (as of 2023, adjusted annually for inflation), with no maximum.

- IRS Penalties: The IRS can impose penalties of $250 per day, up to a maximum of $150,000 per plan year.

- Cumulative Penalties: Both DOL and IRS penalties can apply concurrently, potentially resulting in significant financial consequences.

By understanding and carefully managing Form 5500 filing deadlines, plan sponsors and administrators can ensure compliance, avoid penalties, and maintain the integrity of their employee benefit plans. Leveraging technology solutions, like those offered by PlanTrust, can help streamline the filing process and provide timely reminders and checks to ensure deadline compliance.

Common Challenges in Form 5500 Filing

Despite its critical importance, the process of filing Form 5500 is often fraught with obstacles that can challenge even the most experienced plan administrators. These hurdles range from data management issues to keeping pace with evolving regulatory requirements.

Understanding these common pitfalls is the first step towards developing effective strategies to overcome them, ensuring smooth and accurate Form 5500 filings.

- Data Accuracy and Completeness – Ensuring all required information is accurate and complete can be challenging, especially for large plans with complex financial structures.

- Reconciling Financial Data – Discrepancies between plan financial statements and Form 5500 can lead to audit flags and potential penalties.

- Keeping Up with Regulatory Changes – ERISA regulations and Form 5500 requirements can change, requiring constant vigilance and adaptation.

- Managing Multiple Service Providers – Coordinating information from various service providers (e.g., recordkeepers, trustees, actuaries) can be time-consuming and prone to errors.

- Meeting Deadlines – With the complexity of data gathering and form preparation, meeting filing deadlines can be challenging.

- Understanding Complex Schedules – Some schedules, such as Schedule C (Service Provider Information) and Schedule H (Financial Information), can be particularly complex and time-consuming.

- Ensuring Proper Disclosure – Knowing what information to disclose and how to present it correctly is crucial for compliance.

Best Practices for Form 5500 Filing

Navigating the complexities of Form 5500 filing requires a strategic approach that combines diligence, expertise, and efficient processes. By implementing best practices, plan sponsors and administrators can streamline the filing process, minimize errors, and ensure timely compliance with regulatory requirements.

The following recommendations represent industry-tested strategies to enhance accuracy, reduce stress, and maximize the value derived from the Form 5500 filing process.

- Start Early – Begin gathering necessary information well in advance of the filing deadline to allow time for data verification and problem-solving. Establishing internal deadlines well in advance of the actual filing date will allow time for data collection, review, and potential issues.

- Implement a Robust Data Management System – Utilize technology solutions to organize and manage plan data efficiently throughout the year.

- Conduct Regular Internal Audits – Perform periodic checks on plan data and processes to identify and address issues proactively.

- Stay Informed About Regulatory Changes – Regularly review DOL and IRS guidance and attend industry conferences or webinars to stay current on Form 5500 requirements.

- Leverage Technology – Use specialized software or platforms designed for Form 5500 preparation to streamline the process and reduce errors.

- Establish Clear Communication Channels – Maintain open lines of communication with all service providers involved in plan administration and Form 5500 preparation.

- Implement Quality Control Measures – Establish a review process to double-check all information before submission.

- Consider Professional Assistance – For complex plans or when in doubt, consult with ERISA attorneys or qualified third-party administrators.

Consequences of Non-Compliance

Failing to file Form 5500 or filing it late can result in significant penalties:

- DOL Penalties: Up to $2,259 per day (as of 2023, adjusted annually for inflation) for late filing.

- IRS Penalties: Up to $250 per day, with a maximum of $150,000 per plan year for late filing.

- Additional Penalties: For willful violations or false statements.

These penalties underscore the importance of timely and accurate filing.

Leveraging Technology for Form 5500 Compliance

As the complexity of employee benefit plans and regulatory requirements continues to grow, leveraging technology becomes increasingly crucial for efficient and accurate Form 5500 filing. Here’s how technology can help:

- Data Integration and Management – Advanced data warehousing solutions, like the one developed by PlanTrust, can integrate data from multiple sources, ensuring consistency and reducing manual data entry errors.

- Automated Data Validation – AI-powered tools can perform automated checks on Form 5500 data, flagging potential errors or inconsistencies before submission.

- Real-time Compliance Monitoring – Continuous monitoring systems can track plan data throughout the year, alerting administrators to potential compliance issues well before the filing deadline.

- Benchmarking and Analytics – Tools like PlanTrust’s plan benchmarking solution can help plan sponsors understand how their plan’s fees and performance compare to similar plans, providing valuable insights for Form 5500 reporting and overall plan management.

- Streamlined Workflow Management – Project management features built into Form 5500 preparation software can help track progress, assign tasks, and ensure all necessary steps are completed on time.

- Secure Data Storage and Retrieval – Cloud-based storage solutions provide secure, easily accessible repositories for historical Form 5500 data and supporting documentation.

- Automated Schedule Generation – Advanced software can automatically generate required schedules based on plan data, reducing manual effort and potential for errors.

As the complexity of employee benefit plans continues to grow, embracing technological solutions becomes not just an option, but a necessity for efficient Form 5500 compliance. By leveraging advanced tools like those offered by PlanTrust, plan sponsors and administrators can transform the often daunting task of Form 5500 filing into a streamlined, accurate, and insightful process. These technological advancements not only ensure compliance but also provide valuable data-driven insights that can enhance overall plan management and participant outcomes.

Conclusion

Form 5500 filing is a critical compliance requirement for employee benefit plans, demanding attention to detail, accurate data management, and a thorough understanding of regulatory requirements. While the process can be complex and challenging, adopting best practices and leveraging advanced technology solutions can significantly streamline the filing process and enhance compliance.

As regulations evolve and plans become more complex, staying informed and utilizing cutting-edge tools will be key to successful Form 5500 filing. By partnering with technology providers like PlanTrust, plan sponsors and administrators can not only meet their compliance obligations but also gain valuable insights to optimize their plans and better serve their participants.

Remember, while technology can greatly assist in the Form 5500 filing process, it’s crucial to maintain human oversight and expertise. Regularly reviewing your filing processes, staying updated on regulatory changes, and seeking professional advice when needed will help ensure continued compliance and the overall health of your employee benefit plans.

Disclaimer: This article on Form 5500 filing is for informational purposes only and does not constitute legal, tax, investment, or financial advice. While we strive for accuracy, ERISA laws, Form 5500 filing requirements, and best practices may change. This content is not exhaustive and may not apply to all situations. Plan sponsors, administrators, fiduciaries, and readers should consult qualified ERISA attorneys and professionals for personalized guidance on Form 5500 filing and related compliance matters. PlanTrust, its authors, publishers, and distributors assume no liability for actions taken based on this information. The Form 5500 filing process and related regulations described here are current as of the publication date; readers should verify and stay informed about relevant law changes and updates to Form 5500 requirements. The technology solutions and services mentioned, including those offered by PlanTrust, may be subject to separate terms and conditions not fully detailed in this article.

Ready to Revolutionize Your Form 5500 Filing Process?

Filing Form 5500 doesn’t have to be a daunting task. At PlanTrust, we harness cutting-edge technology to transform Form 5500 filing from a compliance burden into a strategic advantage for plan sponsors and administrators.

Our advanced Form 5500 management solution, built on 15 years of comprehensive data, helps you:

- Automate data collection and validation

- Benchmark your plan’s performance against industry peers

- Identify potential compliance risks before they become issues

- Generate insights to optimize plan management

- Stay ahead of regulatory changes

Don’t let Form 5500 filing overwhelm your team. Take the first step towards easier, more insightful plan reporting.

Contact PlanTrust today for a free consultation and demo of our innovative Form 5500 solutions.

📞 Call us: (800) 918-7305

✉️ Email: success@plantrust.com

🌐 Visit: www.plantrust.com

Empower your Form 5500 filing with PlanTrust – Where Technology Meets Employee Benefit Expertise.